Contents

- 1 CM Punjab Asaan Karobar Finance

- 1.1 What is the Asaan Karobar Finance Scheme?

- 1.2 How to Apply Online for the Asaan Karobar Finance Scheme 2025

- 1.3 Eligibility Criteria for the Scheme

- 1.4 Features of the Asaan Karobar Finance Scheme

- 1.5 Asaan Karobar Card An Additional Benefit

- 1.6 Benefits of the Asaan Karobar Finance Scheme

- 1.7 How This Scheme Will Impact Punjab’s Economy

- 1.8 Conclusion

- 1.9 FAQs

CM Punjab Asaan Karobar Finance

CM Punjab Asaan Karobar Finance The Punjab government, under the leadership of Chief Minister Maryam Nawaz, has launched an exciting and game-changing initiative for small businesses and aspiring entrepreneurs. The Asaan Karobar Finance Scheme offers interest-free loans ranging from Rs 1 million to Rs 30 million, aimed at helping businesses grow and thrive. In this article, we’ll provide all the details about the scheme, how you can apply, and the benefits it offers.

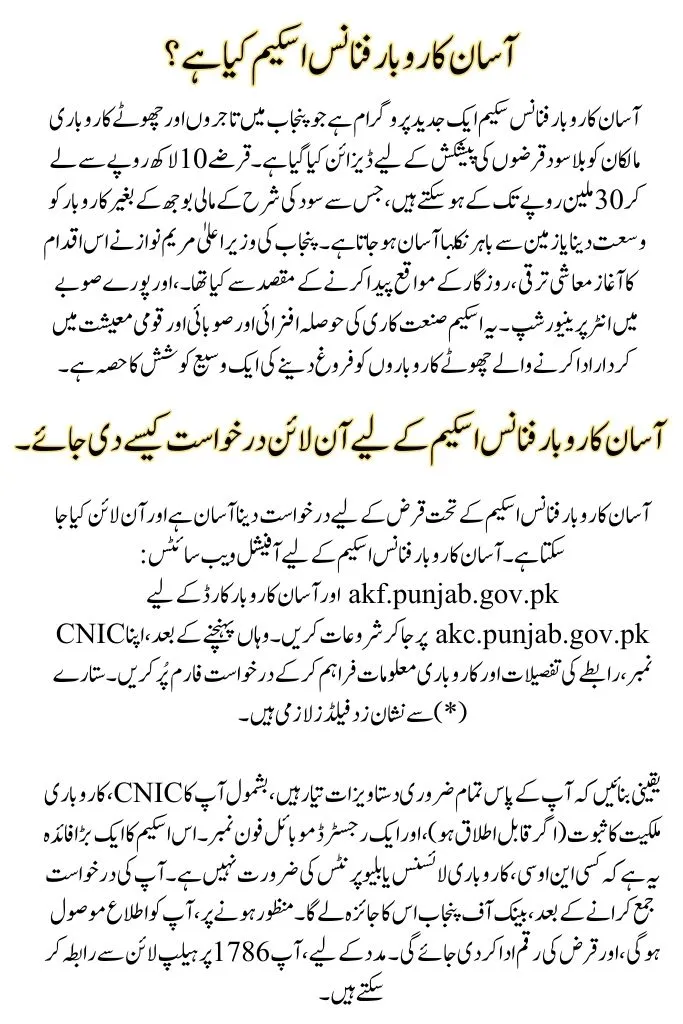

What is the Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Scheme is an innovative program designed to offer interest-free loans to entrepreneurs and small business owners in Punjab. The loans can range from Rs 1 million to Rs 30 million, making it easier for businesses to expand or get off the ground without the financial burden of interest rates.

Punjab CM Maryam Nawaz launched this initiative to support economic growth, job creation, and entrepreneurship across the province. The scheme is part of a broader effort to encourage industrialization and promote small businesses that contribute to the provincial and national economy.

You can also read: PM Youth Skill Development Program 2025 Online Apply Complete Details

How to Apply Online for the Asaan Karobar Finance Scheme 2025

Applying for a loan under the Asaan Karobar Finance Scheme is easy and can be done online. Follow these steps to get started:

Complete Guide

- Visit the Official Websites:

- akf.punjab.gov.pk for the Asaan Karobar Finance Scheme.

- akc.punjab.gov.pk for the Asaan Karobar Card.

- Fill Out the Application Form: You’ll need to provide some basic personal information such as your CNIC number, contact details, and business information. Fields marked with an asterisk (*) are mandatory.

- Submit Required Documents: Make sure to have the necessary documents ready, including:

- CNIC

- Proof of business ownership (if applicable)

- Mobile phone number

- Other documents as requested during the application process.

- No Need for NOCs or Licenses: One of the key benefits of this program is that you don’t need No Objection Certificates (NOCs) or any other approvals like business licenses or blueprints to apply for the loan.

- Application Review: After submitting your application, it will be reviewed by the Bank of Punjab. Once approved, you’ll be notified and the loan amount will be disbursed.

- Helpline Assistance: If you need any help during the application process, you can contact the helpline at 1786.

You can also read: Negahban Program Ramzan Package Registration Through Punjab PSER 2025 (Latest Update)

Eligibility Criteria for the Scheme

To be eligible for the Asaan Karobar Finance Scheme, you need to meet a few simple requirements:

- Age Requirement: Applicants must be of legal age and possess a valid CNIC.

- Business Ownership: The scheme is primarily aimed at small business owners or those who wish to start a business.

- Residency: You must be a resident of Punjab to apply for this scheme.

- No Existing Government Loans: You should not have any existing loans from government programs offering similar financial assistance.

- Business Location: Preference may be given to businesses located in areas with high potential for growth, especially those in export processing zones.

- No Complex Requirements: There are no requirements such as NOCs or licenses, making the application process fast and simple.

Features of the Asaan Karobar Finance Scheme

Here’s a quick rundown of the most important features of the Asaan Karobar Finance Scheme:

- Interest-Free Loans: This is the most attractive feature—loans ranging from Rs 1 million to Rs 30 million with zero interest. You only repay the principal amount in easy installments.

- Flexible Repayment: The loan repayment terms are designed to be as easy as possible, with affordable installments that help you manage your finances better.

- No Pre-Approval Requirements: Unlike many traditional loan programs, you don’t need NOCs, licenses, or even blueprints to apply for the loan. This makes the process smoother and faster.

- Support for Small Businesses: Loans are available for small businesses in various sectors, giving entrepreneurs the opportunity to scale their operations or start something new.

- Land Subsidy: The scheme offers subsidized land rates for businesses looking to set up in Punjab, which can significantly reduce the cost of starting a business.

- Solar Systems for Export Processing Zones: For businesses looking to establish industries in export processing zones, free solar systems worth Rs 500,000 will be provided, ensuring sustainable and cost-effective operations.

Asaan Karobar Card An Additional Benefit

Alongside the Asaan Karobar Finance Scheme, the Asaan Karobar Card has also been introduced. This card offers loans ranging from Rs 500,000 to Rs 1 million, making it accessible to even smaller businesses or those looking for less financial support.

Just like the finance scheme, the Asaan Karobar Card offers interest-free loans and provides a straightforward, hassle-free application process. This is ideal for entrepreneurs who need quick financial assistance to boost their business operations.

You can also read: Ehsaas Nojawan Program Launched For Loan Without Interest In KPK Online Registration 2025

Benefits of the Asaan Karobar Finance Scheme

- Financial Independence: Access to significant capital without interest can help businesses expand or overcome financial barriers.

- Boost to Entrepreneurship: By removing the burden of interest, this scheme gives entrepreneurs the chance to focus more on business growth and less on financial strain.

- Support for Small Enterprises: Small businesses often struggle to get loans from traditional financial institutions. This scheme bridges that gap, making it easier for small businesses to thrive.

- Economic Growth: By helping small businesses grow, the scheme contributes to the overall economic development of Punjab, creating jobs and increasing business activity.

- Sustainability Incentives: The provision of solar systems for export industries helps businesses reduce long-term operational costs and contribute to environmental sustainability.

How This Scheme Will Impact Punjab’s Economy

The Asaan Karobar Finance Scheme is a game-changer for Punjab’s economy. It empowers small businesses and entrepreneurs by providing financial support without the burden of interest, which is often a significant challenge. This initiative will help create more job opportunities, encourage local manufacturing, and increase exports ultimately contributing to Punjab’s economic growth.

CM Maryam Nawaz has emphasized that these programs aim to diversify the economy by promoting entrepreneurship, industrialization, and modernization. This scheme is an important step towards achieving a more inclusive and prosperous Punjab.

Conclusion

The Asaan Karobar Finance Scheme and the Asaan Karobar Card offer a golden opportunity for small businesses and entrepreneurs in Punjab to get financial support without the burden of interest. Whether you’re looking to expand your existing business or start something new, this scheme could be your key to success.

If you’re eligible and ready to take the next step, apply online today through the official websites and start your business journey with the support of the Punjab government.

You can also read: Honhar Laptop Scholarship Program By Maryam Nawaz In 2025 Latest Update & Application Guide

FAQs

How much loan can I get under the Asaan Karobar Finance Scheme?

You can get a loan between Rs 1 million and Rs 30 million based on your business needs.

Do I need any special approvals to apply for the loan?

No, you don’t need any NOCs, licenses, or blueprints to apply.

How do I apply for the loan?

Visit the official websites akf.punjab.gov.pk or akc.punjab.gov.pk, fill out the application form, and submit the required documents.

Is the loan interest-free?

Yes, the loan is completely interest-free and must be repaid in easy installments.

How can I get help during the application process?

You can contact the helpline 1786 for any assistance.

Laon